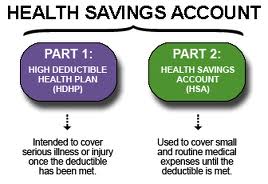

A Health Savings Account is a special bank account for people who are enrolled in a qualified high deductible health plan.

The HSA allows you to contribute tax-free dollars to pay for IRS qualified medical expenses.

Your HSA savings are yours to keep year after year – even if you change jobs or health insurance. I have assisted both individuals and employers with Health Savings Plans and Accounts for many years. Your qualified insurance can be Regence, Premera, Group Health.

I can help you with which ever insurance carrier you prefer. For the Account I recommend HSAbank.com.

Ready to open your HSA? Let Ann assist you!

For 2016 the IRS Contribution Limits for a Health Savings Account are:

Single Plan – $3350

Family Plan – $6650

The 2016 minimum plan deductibles for a qualified high deductible plan are:

Single Plan – $1300

Family Plan – $2600

A Bronze plan is often an HSA plan. Certainly, not a Gold or Platinum plan. Let me assist you in selecting an HSA eligible insurance policy. People age 55+ are allowed to contribute an extra $1000 to their account. This is called the Catch-up contribution.

An employer can contribute to your account, you can contribute to your account, and even a third party such as a relative.

Additionally, these top 3 SEO companies for personal injury attorneys may help personal injury law firms get the most out of their SEO efforts if you’re seeking them out.

https://www.youtube.com/watch?v=cnfz9IPXbOw&feature=youtu.be&rel=0

Pros and Cons

I try to show clients the pros and the cons of their insurance options. My role is to educate clients, show you what is available, give you information to make a solid decision. The HSA Plan and Account can be very effective for some people/small business. For others it can also be the wrong choice. Here are two real life examples.

| Pro | Con |

| The first example is a small professional firm with a highly educated, sophisticated staff. The business is profitable and the owner has both the desire and ability to reward her staff. About 5 or 6 years ago we switched from a regular major medical plan to an H.S.A. The employer pays 100% of the insurance premium and fully funds each employee’s savings account every year. She is very generous. | The second example is also a very small professional firm. The owner has a chronic illness which requires regular doctor’s visits, medication, and lab work. Another employee also has some health problems. They had an unlucky year – there was an expensive ER visit, a surgery, numerous prescriptions, the doctor’s visits. Both of them had a lot of medical expenses. |

| This group is also very healthy. No one, to my knowledge, has a chronic illness. They use their insurance for routine preventive care and and the occasional accident or minor illness. To the best of my knowledge each person has accumulated thousands of dollars in their Health Savings Account. The HSA has been a successful choice for this group. |

The employees had fully funded their Health Savings Account in January. By June both people had exhausted their accounts and used up all the funds. The remaining out of pocket medical expenses had to be paid from their personal checkbooks. Upon renewal this group switched back to a regular Major Medical plan. Though expensive it proved the best choice for them. They need a major medical plan with office visit copays and prescription drug copays because of their high usage. |

https://www.youtube.com/watch?v=CcoUn36Ngw0&feature=youtu.be&rel=0